Make every dollar count.

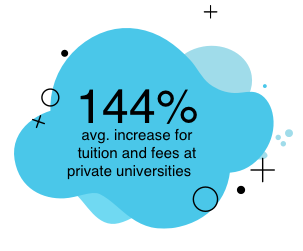

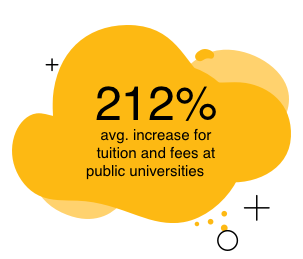

Numbers don’t lie. Over the past twenty years, education costs have risen at public and private schools alike:1

There’s been a 144% average increase for tuition and fees at private universities and an average increase of 212% for tuition and fees at public universities

What can you do? The best strategy is simply to start. Time has the potential to do amazing things for your savings. Let it work for you.

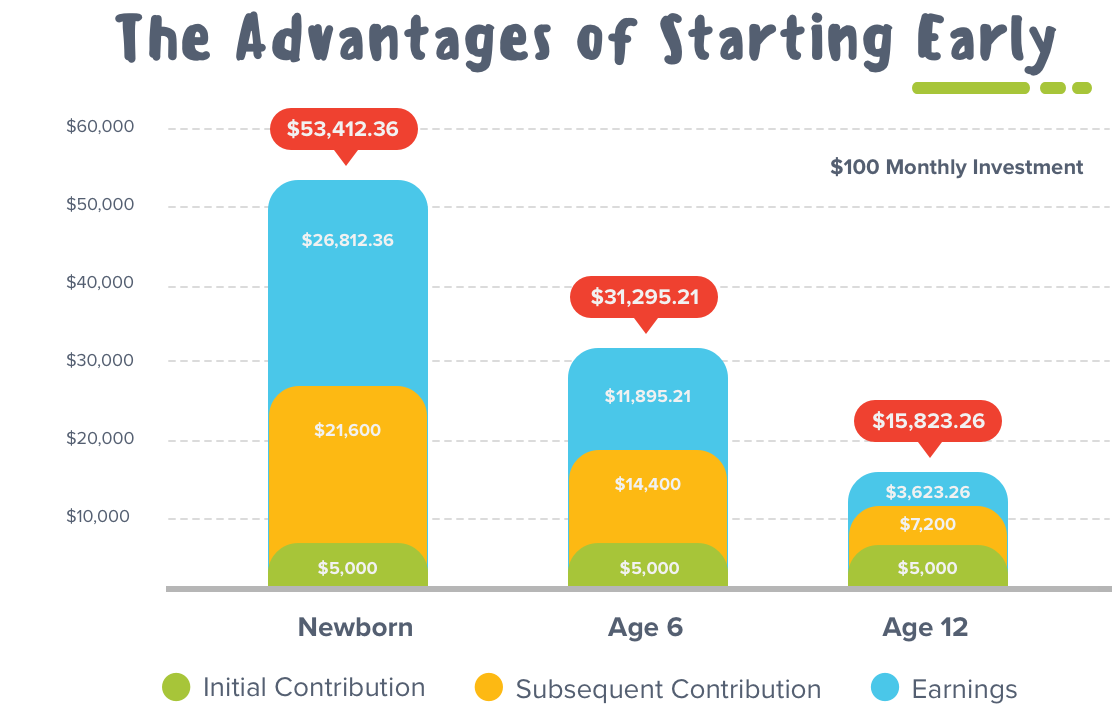

This chart shows that with an initial $5,000 contribution and a monthly contribution of $100 will compound more if you start saving earlier, giving the money more time to grow. If you save $100 a month for 18 years, your ending balance could be $53,400. If you save $100 a month for 12 years, your ending balance could be about $31,300. If you save $100 a month for 6 years, your ending balance could be about $15,800.

These hypothetical examples don't represent the performance of any particular investment. The assumed 6% rate of return is for illustrative purposes only. Actual market returns will fluctuate annually and aren't guaranteed. The ending balance doesn't take into account any taxes or penalties that may be due upon distribution.

Easy to start. Easy to save.

- Open an account. There’s no minimum to start.

- Make saving automatic. Set up recurring contributions right from your bank account.

- Contribute at work. Sign up for payroll direct deposit and contribute as little as $1 per pay period.

Every dollar saved on fees matters, too.

With MOST 529, you’ll pay a low total annual asset-based fee per investment option that ranges from 0.17% to 0.42%, depending on the portfolio(s) you choose.