Use your money for tuition, not taxes.

Having a MOST 529 account can start paying off long before your child moves into a dorm.

Like all 529 plans, the MOST 529 can help your money grow free of state and federal taxes. And if you’re a Missouri resident, you could also enjoy a significant state tax deduction from the first year you open it – and every year after that!

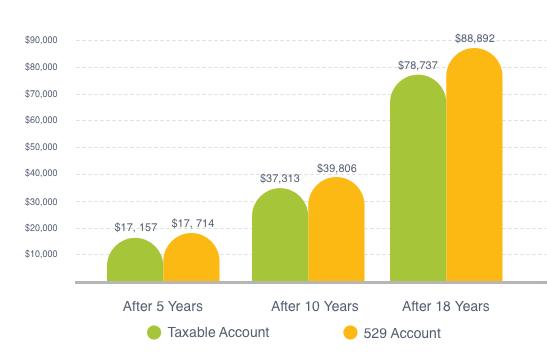

Your MOST 529 savings can grow free of state and federal taxes. What can that mean for you?

If you open a 529 account with an initial investment of $500 and contributed $250 every month for 18 years, there could be nearly $10,200 more for a qualified distribution than the same investment in a taxable account.

Assumptions: $500 initial investment with subsequent monthly investments of $250 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; and taxpayer is in the 24% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon distribution.

Other tax advantages of the MOST 529 Plan:

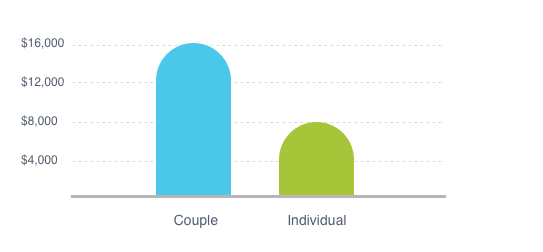

- State tax deduction for Missouri residents (up to $8,000 per person, or $16,000 if you're married filing jointly)

- Tax-free withdrawals when used for qualified expenses1

- $19,000 ($38,000 if married filing jointly) annual gift tax exclusion for qualified contributions

- Estate planning benefits: Reduce your personal taxable estate by making five years' worth of gifts (currently up to $95,000; $190,000 for married couples filing jointly) in one lump sum.2

Annual tax deductions for Missouri taxpayers saving with the MOST 529:

Couples filing jointly is up to $16,000 and an individual is up to $8,000.