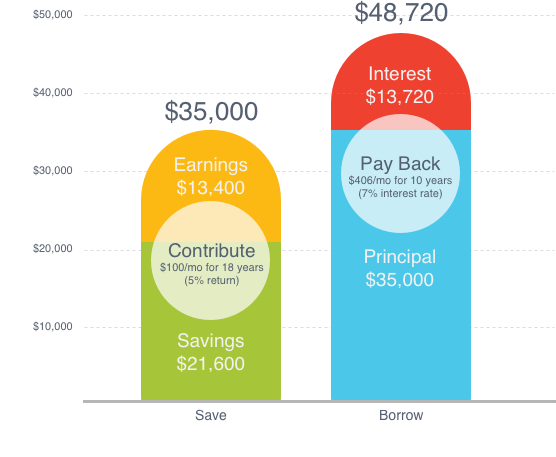

$1 borrowed costs much more than $1 saved.

A dollar isn’t a dollar when it comes in the form of a student loan. That’s because every dollar you borrow will eventually have to be paid back with interest. Saving, on the other hand, beats borrowing every time. When you save, you have the potential to earn money on your money (called a “return”), and even money on your return (called “compounding”).

In this hypothetical example, Family A saved $21,600 over 18 years, and earned an additional $13,400 in return, for a total savings of $35,000. Family B borrowed $35,000, and had to repay the loan PLUS $13,720 in interest. So, Family B paid more than DOUBLE what Family A did for the same $35,000.

The hypothetical example assumes college begins at age 18 and is based on a 5 percent rate of return compounded daily, and is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or taxes, if any, payable upon withdrawal.